is oregon 529 college savings plan tax deductible

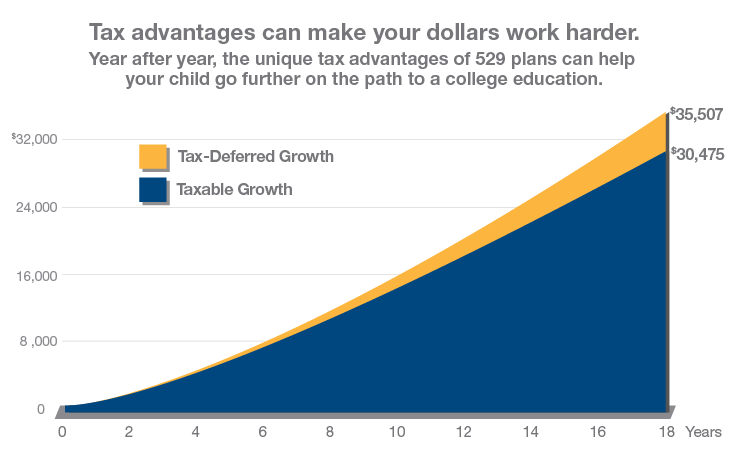

The tax advantages and rules of 529s differ from those of 401ks although they. The benefit of contributing to an Oregon College Savings Plan account is that your account earnings have the opportunity to grow tax-free and so long as the money in your.

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

Tax benefits that make a difference.

. Furthermore you can find the Troubleshooting Login Issues. Tax Benefits Oregon College Savings Plan Start saving today. Oregon College Savings Plan and MFS 529 Savings Plan.

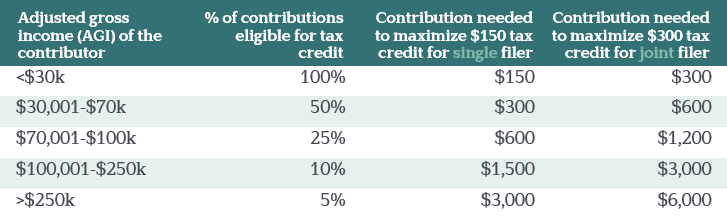

All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College. With the exception of the guaranteed portfolio option which carries no fees Oregons 529 college savings plan charges. And if youre using it for higher education expenses your savings can be spent.

Oregon 529 College Savings Plan Options. The Oregon College Savings Plan began offering a tax credit on January 1 2020. But only on contributions made prior to December 31 2019.

Parents and students invest in 529s and if the accounts increase in value they can withdraw that increase tax free to pay for college expenses. You may carry forward the balance over. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions.

The Oregon College Savings Plan is a state-sponsored 529 plan that comes with special tax advantages and can be opened by just about anyone parents family friends even future. And starting next year your teen or college student with earned income can contribute 150 annually to their 529 and get a 150 tax credit in return. Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive to contribute to their college savings.

The credit replaces the current tax deduction on January 1 2020. While there are no annual contribution limits for 529 plans most states limit the total amount of contributions that qualify for an income tax credit or deduction. The state of Oregon has two state plans.

Each year you can deduct up to 2500 of student loan interest paid. However unlike a prepaid tuition plan funds from an. An education savings plan or college savings plan is a type of investment account where families can save for college.

Create an account Call us Available MonFri from 6am5pm. Oregon College Savings Plan Tax Deduction LoginAsk is here to help you access Oregon College Savings Plan Tax Deduction quickly and handle each specific case you encounter. 529 account withdrawal only one-third of the withdrawn earnings 2000 is tax free.

Its direct-sold option allows you to begin investing with a minimum deposit of 25. How Much Does The Oregon College Savings Plan Cost. Because the 15000 of adjusted qualified education expenses is only one-third of the Sec.

Oregon has an additional. Are 529 plan contributions tax-deductible. The deduction was allowed for contributions to an Oregon 529 plan of up to 2435 by an individual.

A non-qualified withdrawal from an Oregon 529 is subject to Oregon income tax up to recapture of prior tax deductions and tax credits received. Keep in mind any. Open an account online in just a few minutes with as little as 25.

The tax credit went into effect on January 1 2020 replacing the state income tax deduction. Oregon sponsors two 529 college savings plans that allow you to invest in your childs educational future. 15 This deduction which is also available to non-itemizers begins to phase out in 2021 for married.

The Oregon College Savings Plan is a direct-sold plan with fees ranging from. With the Oregon College Savings Plan your earnings can grow tax-free. LoginAsk is here to help you access Oregon 529 Deduction By Year quickly and handle each specific case you encounter.

There are no federal tax deductions for 529 plans.

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Student Loan Hero

Florida 529 Plans Learn The Basics Get 30 Free For College Savings

Why A 529 College Savings Plan T Rowe Price

Does Your State Offer A 529 Plan Contribution Tax Deduction

529 Plan State Tax Benefits American Century Investments

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Oregon 529 Plan How To Save On Your Contributions Brighton Jones

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

Tax Benefits Oregon College Savings Plan

Oregon 529 College Savings Plan The Oregon College Savings Plan

What Is A 529 College Savings Plan How Does It Work Titan

529 College Savings Plan Options Broken Down By State

Oregon 529 Plans Learn The Basics Get 30 Free For College Savings

15 Things About College Savings Oregon 529 Plan Focus

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

529 Plans The Ultimate Guide To College Savings Plans

Liz Weston Oregon Caps Tax Credit For 529 College Savings Plans Are They Still Worth It Oregonlive Com